Are Crypto Perpetual Futures Halal?

Perpetual futures are also a major reason why leveraged wipeouts in crypto can reach hundreds of millions or even billions of dollars in a single day. Because every position depends on margin, even small price movements can push thousands of traders toward liquidation at the same time. When a liquidation happens, the system automatically closes the position, which adds immediate selling pressure to the market. That extra pressure can push the price down further, triggering even more liquidations. This chain reaction is known as a “liquidation cascade,” and it is why sudden drops in the crypto market often create very large, very fast losses for leveraged traders.

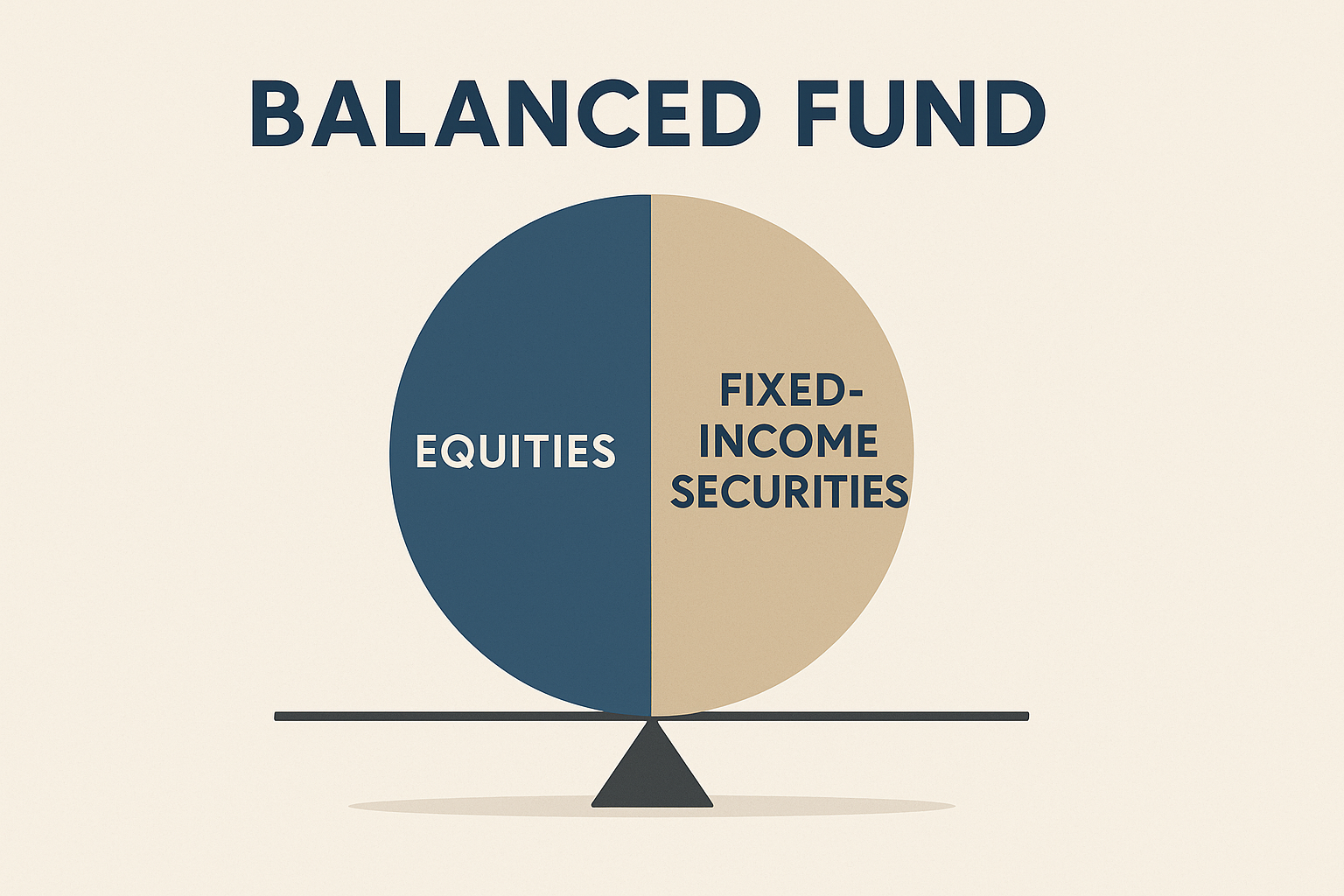

The Shariah Ruling on Conventional Balanced Funds

This article examines how conventional balanced funds mix equities with riba-based bonds, why this structure is impermissible, and how Islamic balanced funds differ.

Why Islamic Finance Should Not Hesitate in the Blue Economy

The blue economy could reach USD 3 trillion by 2030, yet it remains one of the least financed areas of sustainable development. Research shows that Islamic finance hesitates not because of faith-based limits, but due to structural gaps such as fragmented regulation and limited expertise. Built on real assets, trust, and shared benefit, Islamic finance has the tools to unlock ocean investment and turn ethical stewardship into tangible, investible impact.

Decarbonising Finance under Shariah: Understanding Carbon Credits and Offsets

Carbon trading is reshaping climate finance — but is it compatible with Shariah? AmanX explains how carbon credits can qualify as tradable regulatory rights, while carbon offsets demand stricter proof of authenticity. True Islamic decarbonisation means moving beyond symbolic trading toward real, measurable climate impact through ethical investment and stewardship.

Are DeFi options Shariah-compliant?

Options are becoming one of the most popular yield strategies in decentralised finance (DeFi), but are they halal? This article explores what Islamic scholars say about options trading, reviews key DeFi strategies such as covered calls, cash-secured puts, and tokenised option vaults, and applies Shariah principles to assess whether these contracts are compliant.